SmartAB™ Wisdom #58: The Evolution Of Venture Capital – Venture Studios And Family Offices To The Rescue…

John Caples wrote the most brilliant branding and marketing tagline almost 100 years ago. He said: “They laughed when I sat at the piano, but when I started to play…”

So, in homage to John, I will say this: They laughed when I warned about the dismal returns from the venture capital industry when the Limited Partners (LPs) showered the General Partners (GPs) with money. Today, the venture capital market has experienced a notable downturn, particularly in early-stage funding, with both deal volume and investment declining in Canada and the U.S. – and nobody laughs anymore...

So, how bad is it? Well, the number is a five-year low according to Canadian Venture Capital Association (CVCA) data. This decline is attributed to factors like cautious investor behavior, increased interest rates, and macroeconomic uncertainty.

While some sectors like AI are seeing increased investment, overall VC activity has fallen, impacting startup funding and valuations. Here's a more detailed look at the decline:

1. Declining Deal Volume and Investment:

Canada: In Q1 2025, Canadian VC investment decreased by 3.8% compared to the same period in 2024, with a 20.5% drop in deal counts. Seed deals in Q1 2025 hit a five-year low, and early-stage funding experienced a steep decline.

U.S.: While not as drastic as Canada, the U.S. also saw a decline in early-stage funding, with pre-seed and seed-stage investments decreasing in 2024.

Global: Global VC funding in Q3 2024 experienced a 16% decrease compared to Q2, with a decline led by fewer large, late-stage rounds.

2. Cautious Investor Behavior:

· Investors are becoming more cautious and risk-averse, leading to a slowdown in deal flow.

3. Increased Interest Rates:

· Higher interest rates have made it more expensive to borrow money, which can discourage companies from seeking VC funding.

4. Inflation and Economic Uncertainty:

· Economic uncertainty and inflationary pressures are also contributing to investor hesitancy.

5. Shift in Priorities:

· Some investors are shifting their focus towards profitability over growth, impacting late-stage funding.

6. Reduced Exit Opportunities:

· A decline in exit opportunities, such as IPOs and acquisitions, can also affect VC returns and lead to a pullback in investment.

So, how exactly are the Startups affected by such new realities? The list of the “Pareto-style” vital few follows below:

Funding Delays: Startups may face delays in closing funding rounds and may need to adapt their strategies for attracting investment.

Valuation Adjustments: Valuations are being adjusted downwards as investors become more cautious, which can impact fundraising and the value of existing investments.

Focus on Sustainability: Startups may need to focus on building sustainable business models rather than solely chasing rapid growth, as funding may be more difficult to come by.

In many of my previous posts, I frequently covered the ups and downs of access to capital from Angels, Institutional VCs (IVCs), CVCs, and PEs. And I did so for a good reason. Even before the explosive growth of AI, the amount of risk facing VC stakeholders pointed to an alarming “six feet under” reality. Within ten years:

· Over 90% Of Startups Fail - and meet their “Startup Mortician”…

· Less Than 10% Of Startups Succeed – but deliver disappointing ROIs to their investors…

LPs and GPs: It’s Time To Look In A Mirror…

Well, 20 years of statistics don’t lie. No amount of startup incubators and accelerators over the last 20 years made any difference. It didn’t change the gloomy stats one iota since the launch of Y-Combinator in 2005.

According to tracxn.com, the United States has 2.79K Accelerators & Incubators which have a combined portfolio of 28.7K companies. Similarly, according to incubatorlist.com, there are 123 Canada-based startup accelerators and incubators. And many additional countries show similar records.

So, since some of the accelerators and incubators have been around for 20 years, it is time to admit that crafting shiny Vision and Mission Statements is necessary but insufficient…

The longer-term reality is much less forgiving than watching Unicorns turn into… Little Ponies. To endure, companies and their investors must embrace new and innovative strategies to achieve greater sustainability…

You can find more details on how I compare VCs, CVCs, and PEs in Chapter 8 of my book: “AI Boogeyman”, in addition to my LinkedIn posts, such as:

· LeanCVC™ - A Match Made In Heaven

· How To Turn Corporate Venture Capital Into A Magnet For Raising CAPITAL

· Corporate Venture Capital – The Most Underutilized Factor Endowment Of Corporate Giants

However, strategically speaking, VCs and CVCs significantly differ. While VCs are primarily looking at the ROIs and their financial returns, CVCs operate under a two-dimensional space, looking at ROIs and the STRATEGIC fit. I chose to highlight such differences under the term of ITTs - Ideas, Teams, and Traction.

Ideas

Angel Investors & VCs care very little about your ideas. Even if some of your ideas are close to their existing expertise – building a successful business from an idea stage is a lot of work! They know that and have very little appetite to go there…

So be prepared to hear a lot of dismissive and condescending remarks about ideas, such as: “Ideas are a dime a dozen” or “Ideas are cheap and abundant; what is of value is the effective placement of those ideas into situations that develop into action”…

Guess what, CVCs and Venture Studios turned the tables on conventional VCs and openly declared: All you need is… IDEA. We do the rest… To me, it’s…quite AMAZING!

So, instead of listening to ideas, conventional VCs make two educated guesses about your Team & your Traction.

Teams

Demonstrating past wins looks good on your resume and in front of VCs. Serial entrepreneurs bring respectability to new ventures – even if their previous successes are linked to different markets. Solid technical skills and experience in marketing, sales & branding – a big plus! So, all the Pitch Decks emphasize the “winning” TEAMS behind their ventures.

Well, once more, Venture Studios have all the winning teams in place already. So, stick to ideas instead of parading all your Einsteins in front of the VCs. Still not convinced? Well, let me remind you what Eleanor Roosevelt once said about it: “Great minds discuss ideas; average minds discuss events; small minds discuss people”

Traction

In simple terms, Monthly Recurring Revenue, or MRR - is the most important metric that VCs and Angel Investors seek. Especially if you’re pitching a subscription business model. And since your MRRs are usually quite recent, challenges such as retention and churn – seldom apply.

And it boils down to this: No traction? No presentation… The conventional VCs will dismiss your pitch in a heartbeat. But not the Venture Studios… The VC revolution has just begun. So, fasten your seat belt and enjoy the ride to the VC Studio near you…

Beyond ITTs – Venture Studios & Family Offices

However, the conventional VC doom and gloom doesn’t reflect the overall financing status, and here is why… From a structural perspective, both VCs and CVCs use their LPs' money, and one can freely argue that CVCs rely on their Corporate Parents to “raise” the funds, too. In the same way that GPs need to court institutional investors to become their LPs, CVCs need to pursue their corporate BODs to secure the funding.

All such processes, of course, expose the risks of dealing with economic and political uncertainties TWICE: while raising the funds, and then while investing in promising startups. Hence, I asked myself, what would be the opportunities to tap into the “LP-less” financing options? The answer is quite simple: it boils down to venture capital coming from… Venture Studios and Family Offices.

In a recent HBR article, Steve Blank says: “Startup founders often look to incubators and accelerators to help them find product/market fit and raise initial capital. But there’s another option for entrepreneurial founders who want to go out on their own but maybe lack the right idea or team”

So, if you ever wondered about the ways you can reduce startup risks, Steve adds: “In the last two decades, three types of organizations — incubators, accelerators, and venture studios — have emerged to reduce the risk of early-stage startup failure by helping teams find product/market fit and raise initial capital. Most are founded and run by experienced entrepreneurs who have previously built companies and who understand the difference between theory and practice.”

Venture Studios – Thinkering and Tinkering For A Boost…

In simple yet very elegant terms, Steve further explains the differences and similarities between the alternatives:

“Accelerators - look for founders who have a technical or business model insight and a team. Accelerators provide these teams with technical and business expertise and connect them to a network of other founders and advisors. The culmination of this bootcamp is a “demo day” where all startups in the cohort have a few minutes to pitch their companies to venture capitalists and angel investors. (In some cases the accelerator provides initial funding themselves.) In exchange for attending an accelerator, startups give up 5% to 10% of their company’s equity”.

Incubators - are similar to accelerators in that they provide space and shared resources to startups, but usually no or very small amounts of capital. Their financial models are based on membership fees that grant access to a shared coworking space, resources, and access to other founders and operational expertise.

Venture Studios - create startups by incubating their own ideas or ideas from their partners. The studio’s internal team builds the minimum viable product, then validates the idea by finding product/market fit and early customers.

If the idea passes a series of “Go/No Go” decisions based on milestones for customer discovery and validation, the studio recruits entrepreneurial founders to run and scale those startups.

However, although Steve adds: “Unlike an Accelerator or Incubators, a Venture Studio doesn’t fund existing startups” – well, there are many exceptions to this rule already. Plenty of Venture Studios offer pre-seed funding…

I receive between 10 to 15 invitations to make pre-seed startup submissions from various Venture Studios each week. So, Venture Studios are definitely interested not only in organic ideas but also in pitch decks from the outside world…

So, no generalizations, please. It reminds me of one of my favorite quotes by Donald Rumsfeld: "All generalizations are wrong... including this one".

In a superb white paper published by GSSN’s Nick Zasowski, we can learn much more about Venture Studios. Nick says: “Startup studios (referenced as “studios” throughout this paper) are interchangeably known around the globe as venture studios, venture builders, or company builders. Simply put, studios are company creators.

They solve real problems by matching great business ideas with the best entrepreneurial talent to execute those ideas. Studios then test these ideas and back them with funding and resources in order to launch and grow powerful, scalable startups”...

And Venture Studios’ statistics are equally impressive. “The startups coming out of studios have a unique composition. These companies solve the world’s biggest problems with the world’s best entrepreneurs.

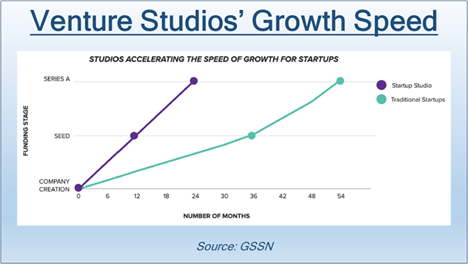

Because of this, the success of these startups is unprecedented. The stunning 84% of startups coming out of studios go on to raise a seed round. Of those startups that make it to the seed round, 72% of those ventures make it from seed to Series A, compared to traditional startups in which only 42% of ventures that get to seed… make it to Series A. Ultimately, 60% of all companies created out of studios make it to Series A”…

So, how much better is the Venture Studio approach in comparison to traditional startup building? Well, GSSN has the answer: “The studio approach is achieving better results (30% better to be exact) as they build repeatable processes, focus on their specific expertise, have skin in the game from day one as an institutional co-founder, and provide financial resources. GSSN surveyed 258 startups created by studios. They have the expertise, skin in the game as a co-founder, and provide financial resources”…

And equally ambitious BX Ventures, a cleantech Venture Studio aiming to “build, fund and scale cleantech startups that contribute to a net-zero society” - puts it bluntly:

“Venture builders (also known as startup studios or foundries) are known for offering extensive support to their portfolio companies. Unlike other innovation ecosystem intermediaries, this includes direct and hands-on strategic, operational, and capital support.

It results in systematic de-risking of the startup launch stage. It also results in superior returns than traditional venture capital while generating lower waste (quantifiable as the % success rate of their portfolio companies achieving Series A financing).

For the past decade, there has been an ode to the lone-wolf entrepreneur. Do-it-all-yourself was seen as a “rite of passage” for young risk-hungry entrepreneurs looking to brave the gauntlet of the startup launch stage.

Successful entrepreneurs have been celebrated as heroes of capitalism and unicorns have been the ambition of all. In a period where demand for technology, access to early-stage capital, and a rise in valuations were unparalleled, this was the perfect environment for the classical entrepreneurial approach.

When entrepreneurs partner with venture builders (instead of embarking on a do-it-all-yourself journey), the following benefits are experienced for the underlying startup:

· The probability of raising a Series A increases by roughly 5x,

· The time taken to get to Series A is decreased by roughly 2x,

· The returns achieved are increased by more than 2x.

In simple terms, venture builders are professionalizing the venture launch stage and such results are exactly what cleantech innovation ecosystems need to accelerate and become more efficient”...

But I think that there is another factor that is often overlooked when analyzing the successes of Venture Studios as an asset class: The age of experienced entrepreneurs matters…

According to Inc. Magazine and MIT: “A recent study conducted by the Census Bureau and two MIT professors found the most successful entrepreneurs tend to be middle-aged--even in the tech sector.

The researchers compiled a list of 2.7 million company founders who hired at least one employee between 2007 and 2014. The average startup founder was 45 years old when he or she founded the most successful tech companies.

And in general terms, a 50-year-old entrepreneur is almost twice as likely to start an extremely successful company as a 30-year-old”… Yes, older founders are more likely to succeed!...

Family Offices – “Ecosystems Around Conviction”

It may come as a surprise to many, but family offices actively invest in startups, particularly those with strong growth potential and strategic alignment with their values and expertise. They are significant players in the startup funding landscape, contributing nearly a third of all capital invested globally in startups.

According to Fortune, “Family office investing is a significant force in global wealth management, with an estimated 8,030 single-family offices managing $3.1 trillion in assets. This is projected to grow to over 10,720 family offices managing $5.4 trillion by 2030. The wealth of families with family offices is also expected to increase, from $5.5 trillion currently to $9.5 trillion by 2030.

Reasons for Family Office Investment in Startups:

Strategic Alignment:

Family offices often seek partnerships with startups that offer innovative solutions or technologies relevant to their existing businesses or family values.

Long-Term Perspective:

Family offices have a longer investment horizon than traditional venture capital funds, allowing them to invest in companies with a focus on long-term growth and impact.

Patience Capital:

Family offices are less driven by the need to realize short-term returns, which allows them to take on more risk and invest in companies with higher growth potential.

Access to Expertise and Networks:

Family offices can provide valuable access to their own networks and expertise, helping startups navigate challenges and build relationships.

Strategic Partnerships:

Family offices often invest in startups to gain strategic partnerships and access to innovative technologies, rather than just seeking financial returns.

How Family Offices Invest:

Direct Investments:

Family offices can invest directly in startups by purchasing equity or providing loans.

Venture Capital Funds:

Family offices may also invest in startups through venture capital funds, which can help them diversify their portfolio and access a wider range of investment opportunities.

Club Deals:

Many family offices prefer to invest in startups through club deals, where they co-invest with other institutional investors, sharing the risk and potential rewards.

As Dr. Janét Aizenstros, Chair of Kingdom Dominion Capital (formerly Ahava Holdings and Ventures), rightfully observed in The Sovereign Standard:

“At its best, the family office space cultivates vertical clarity—where capital, conviction, and covenant intersect. Relationships aren’t leveraged for status; they’re built on long-term trust, estate vulnerability, and geopolitical awareness. From private investment advisors to multi-generational principals, there’s a sobriety in the conversation that many institutional groups have lost. It’s not louder. It’s just real.

For family offices, sovereign investors, and Fortune-tier operators, this shift carries weight. Boardroom strategy, philanthropic alignment, and legacy succession planning must now factor in authenticity as a governance principle. Not because it’s fashionable, but because post-performance leadership will define the next two decades of economic and cultural infrastructure.

This is especially true for capital stewards and private wealth advisors who serve as gatekeepers to influence. The best among them are no longer building portfolios solely around assets—they’re building ecosystems around conviction. The highest-return environments in the next era won’t be determined by yield alone. They’ll be shaped by the courage to be in rooms where no one is rehearsing.

And she adds: “Carol Pepper, CEO of Pepper International and a globally recognized family office advisor, confirms this shift: “We’re entering a golden era of the family office. Leaders are realizing they don’t need branding exercises—they need purpose. These are people managing legacy, not launching product lines. And their conversations are finally matching the weight of that responsibility.” She adds, “Family offices are the last frontier of private capital behaving like sovereign capital. What they care about now is alignment, not applause.”

Family Offices By The Numbers

Here's a more detailed look at the scale of family office investing by Deloitte:

The number of family offices globally is expected to grow by one-third from 8,030 today to 10,720 in 2030

The family office arena has been growing rapidly, parroting the rise in family wealth globally, and this growth is expected to continue in the coming years. Family offices’ surge in popularity is driven by a combination of factors, including increased wealth concentration, successful transfers of generational wealth, the large-scale sale of family-owned businesses, which created liquidity events, and the pursuit of more customized investment strategies and services.

The predicted transfer of trillions of US dollars of wealth between generations over the next 10 years is expected to have a notable impact on family offices and their AUM going forward. And new wealth sources from an increasing number of entrepreneurs exiting the companies they started will likely cause the number of family offices and their combined AUM to rise even higher.

Today, there are an estimated 8,030 single-family offices worldwide. This proportion has increased by nearly one-third (31%) over the last five years from circa 6,130 offices. It is expected to rise another 12% to 9,030 family offices by next year and 33% to 10,720 family offices by 2030. In turn, over a circa 10-year period (2019 to 2030), the proportion of family offices globally is expected to jump by a notable 75%.

Until now, North America has been the fastest-growing region; moving forward, it is expected to be outpaced by Asia Pacific

The most significant increases in family office expansion are expected to come from North America and Asia Pacific. At present, there are an estimated 3,180 single-family offices in North America, up 44% from 2019. This proportion is expected to grow to 4,190 by 2030, nearly doubling (90%) between 2019 and 2030.

In Asia Pacific, there are an estimated 2,290 single-family offices today, up 28% from 2019. While North America has experienced the greatest rise in family offices to date, Asia Pacific is expected to outpace the region moving forward. The number of family offices in Asia Pacific is expected to grow 40% by 2030 to 3,200 offices, while North America is expected to rise 32%. In turn, North America is projected to experience the most growth between 2019 and 2030 (90% versus 79% for Asia Pacific). However, the pace at which the landscape in North America is expanding is slowing down, given its relative maturity, while in Asia Pacific, it is heating up, given its more recent emergence in family offices.

The family office arena in Europe is also expected to experience considerable growth, but at a somewhat slower pace than North America and Asia Pacific. This is likely a sign of its maturity and weakened economic climate. Today, there are an estimated 2,020 single-family offices in Europe, up 20% from 2019. This proportion is expected to grow 13% by 2025 (to 2,290 offices) and 58% between 2019 and 2030 (to 2,650 offices).

The family office space in the Middle East can best be described as nascent, as the region is estimated to hold a mere 290 fully functional single-family offices. However, times are changing as the proportion of family offices is expected to increase by 21% by 2030.

Family offices hold US$3.1 trillion in AUM globally; this is expected to rise 73% to US$5.4 trillion by 2030

Family offices may continue to gain influence in financial markets as their AUM rises. While family offices currently manage an estimated US$3.1 trillion in assets, this figure is expected to grow to US$5.4 trillion by 2030, as they continue to establish themselves as a financial powerhouse.

The family offices with the greatest investment power lay in North America, which has a total estimated AUM of $1.3 trillion, followed by Europe (US$949 billion), Asia Pacific ($590 billion), and the Middle East (US$159 billion). Given this expected growth, family office AUM is on track to surpass the current AUM of the global hedge fund industry, which is US$5 trillion.

Given the large-scale projected rise in wealth and family office AUM, this could have a considerable impact on the family office arena. For instance, the competition for highly skilled talent could further intensify, alongside greater demand for third-party service provision to support the growth in family office activity. The number and nature of family office services and structures could expand, heralding a need for further professionalization and dedicated financial, legal, tax, and regulatory offerings from family office hubs.

Family offices primarily source their staff from financial services, accounting, and consulting firms

When asked what sectors they most commonly recruit their staff from, the majority of family offices said from financial services firms (64%), followed by accounting firms (44%), consulting firms (25%), other family offices (22%), law firms (17%), and the family‘s operating business (17%). Here, however, it is important to appreciate that family offices typically offer an array of services. Their hiring needs can thus vary across investing, tax planning, trust and estate planning, insurance, legal services, and more, so a mix of skill sets is often needed.

The average family office has 15 members of staff

Looking more closely at the composition of their staff, the average family office surveyed has a mere 15 employees19 while managing a significant US$2 billion in AUM—something that is no small feat (figure 17).20 This proportion, of course, varies somewhat, with the larger (those with over US$1 billion in AUM) and older (Gens 4+) family offices having an average of 23 and 24 staff, respectively, and the smaller offices (those with under US$1 billion in AUM) having merely 10.

Among these staff, the majority are non-family professionals: an average of 13 out of 15 globally, as family offices tend to have just one or two family members working within the office, leaving the majority of the day-to-day responsibilities to non-family professionals.

Investments In Innovative Startups

According to PWC: “Family offices are major players in funding innovation, being responsible for 31% of investments in startups, and with 83% of those executed as club deals. Generative AI (GenAI) is one of the fastest-growing and most popular areas for family office investments in startups. Based on the latest research findings, these trends are detailed below:

Global family office investments stabilise after recent Decline

After reaching an all-time high in the second half of 2021, both the volume and the value of family office investments in startups have fallen significantly, with deal value slumping by over 71%. However, the rate of decline in both volume and value has slowed sharply, with deal volume remaining at almost the same level over the past two half-year periods. So it appears that the fall seen in recent years may be reaching a plateau.

· Family offices lead the way in SaaS and AI & ML investments

An analysis of family offices’ startup investments by sector over the past year reveals that software-as-a-service (SaaS) and artificial intelligence and machine learning (AI & ML) were the industry verticals in which family offices invested the most often, and also the most value, worldwide. These sectors were followed by FinTech and life sciences in terms of both deal volume and value.

In Summary

The VC investment landscape is changing, and Family Offices are increasingly filling the gap. “They provide comprehensive services to manage the wealth and interests of ultra-high-net-worth individuals and families, typically across multiple generations. While each family office is as unique as the families themselves, most of them strive to achieve common objectives, including wealth and risk management, coordination of services, enrichment of the family’s legacy, and privacy of the family’s affairs.

In their approach to wealth management, family offices typically set and lead a family’s wealth strategy, oversee members’ investment portfolios, and manage operational costs and tax considerations. Among other things, they also support the education and involvement of family members, oversee relevant governance structures, and assist in the development and execution of succession plans.”

So, don’t be a pessimist about the probability of raising startup funds from conventional VC players and stop seeing the glass half empty. Stay positive and remember the following story about the shoe salesman…

· A shoe company sends two salesmen to a remote island to determine the market potential…

· On arrival, they both discovered that NOBODY wears any shoes…

· One reported: no one here wears any shoes - there is no market for us…

· The other one sent a different message: no one here wears any shoes - there is a huge market for us, send all the inventory…

As per RBC’s “THE NORTH AMERICA FAMILY OFFICE REPORT 2024, "The key feature of family office investment in recent years has been an ever-increasing allocation to private markets, which now constitute 30 percent of the average portfolio. Family offices still expect private equity and venture capital to supply the best long-term risk-adjusted returns.”

So, this is why Venture Studios and Family Offices take Warren Buffett’s advice very seriously. He said:

· “Rule #1: Never Lose Money”

· “Rule #2: Never Forget Rule #1”

And yes, there are many startups that solve major problems but do not make any money, and then there are many startups that make a lot of money but do not solve any problems. Founders can now use the KEE (Knowledge, Experience, and Expertise) from Venture Studios and Family Offices to do both… and unlock the Gates of Prosperity.

For More Information

Please see my other posts on LinkedIn, X, Substack, and CGE’s website.

AI Boogeyman

You can also find additional info in my hardcover and paperback books published on Amazon: “AI Boogeyman – Dispelling Fake News About Job Losses” and on our YouTube Studio channel…

SmartAB™ - SUBSCRIBE NOW

A Radically Innovative Advisory Board Subscription Service...